Foreign trade order quantity fluctuates now, freight forwarder starts price war! "Sky-high" sea freight continues to fall

The "crazy" shipping continues to fall, the "difficult to find a space" situation has been reversed, instead, shipping companies are holding the space around looking for cargo.

Data released by Drury, Baltic sea, Shanghai Hna Exchange, Ningbo Shipping Exchange and other shipping consulting institutions show that spot freight prices of some routes from Asia to Europe and the United States continue to decline, and the demand for collective transportation is also declining.

"Sky-high" sea freight continues to fall, export enterprises feel not obvious

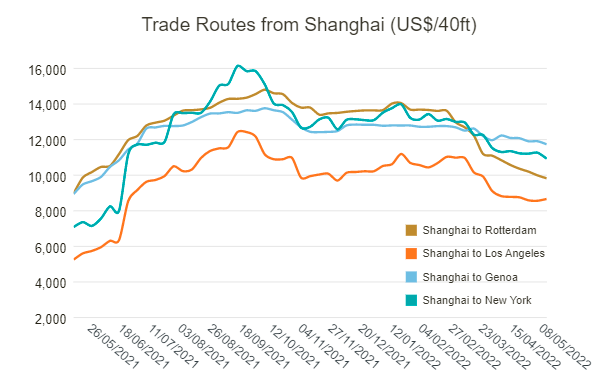

Affected by the epidemic, sea freight remained high in 2021, and has fallen significantly since the peak in the Spring Festival. So far, they have averaged about 20%. The United States east the United States west route appears larger drop, The European route drop is larger.

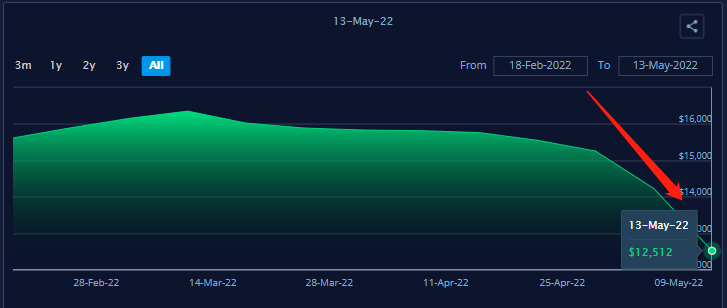

On May 13, the latest Edition of the Baltic Sea Freight Index FBX showed prices from Asia to the western US falling to $12,512 per 40-foot container, the lowest since July last year.

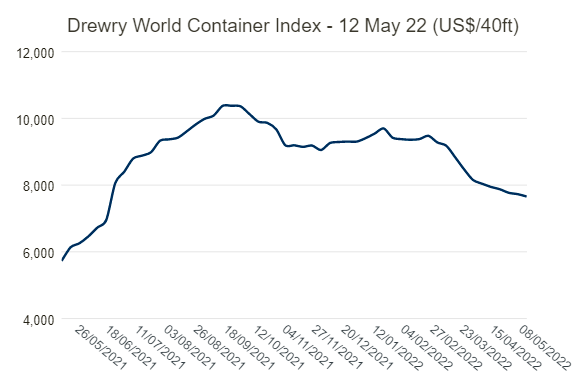

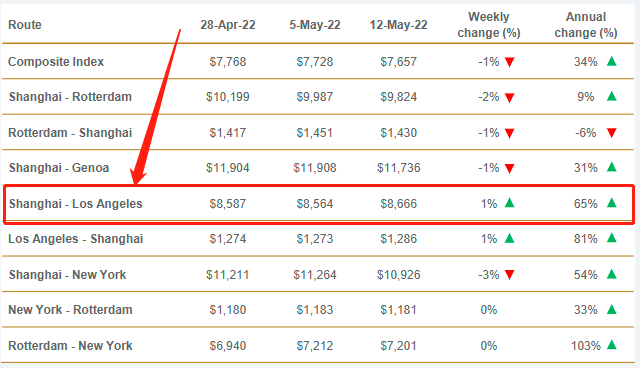

Drury's World Container Index (WCI) has fallen more than 16% in the year to April. On April 14, the WCI Composite index fell below $8000 /FEU, down 0.9% month-on-month and back to freight rates last June. The latest WCI composite index (May 12) fell to $7657.20 /FEU.

Only the Index rose by a modest 1%.

Data released by The Shanghai Shipping Exchange showed that the average value of China's export container Freight Index (CCFI) was 3,131.53 points in April, down 6.0 percent from the previous month. After hitting a recent high in the fourth quarter of 2021, CCFI has been declining for more than 20 weeks since December 2021.

From January 28 to May 6, China's export container freight index decreased from 3565.33 to 3056.98, a decrease of 14.25%; Shanghai's export container Freight Index fell 16.89 per cent to 4,163.74 from 5,010.36.

However, it is worth noting that the latest CCFI index (May 13) showed a slight recovery, with a 1% increase from the previous period to 3088.03 points.

Although the indices are all down, freight rates from Asia to Europe and the US are still high compared with a year ago. According to the Baltic's freight index, FBX, it is still double the $12, 512 it was at $6, 536.50 per FEU in May last year.

Although the recent sea freight has fallen, but the sea freight is still at a high level, the order volume did not produce obvious stimulus, for doing CIF foreign trade enterprises to fall the sea freight, quite the seller's profits. The feelings brought to foreign traders are not obvious.

Transport costs remain high, with more space available but higher towing costs

The drop in freight rates indicates that the demand side of the shipping market is slipping. Demand for seaborne container shipments has fallen for a fifth straight week, according to the latest data from shipping consultancy Sea Intelligence.

Last year, the situation of "difficult to find a cabin" has been reversed. Instead, shipping companies scour the shipping space for cargo. The most obvious is, according to the feedback of textile export enterprises, the present cabin is sufficient and surplus, unlike last year, the need to grab the cabin. Recently, there are more forwarders selling shipping space, booking space is much easier than last year. Carrier performance is more obvious, before the ship company 20GP small container, on the cargo is also strict weight limit, and now the basic is to take the principle of nothing to refuse.

After the Spring Festival, the first and second quarters are generally off-season, and the second half is the peak shipping season. The shipping market has been tepid since the Spring Festival this year, and many exporters have not received new orders, leading to a decrease in exports. Have the colleague expresses, the European line freight price plummet, the main reason is the cargo quantity is less and at the same time ship company transport capacity increases. In fact, cabins are often met with empty cabins or retreats.

According to thepaper.cn, in early April, the towing fee from suzhou factory to Shanghai port had risen to 2,300 yuan, and on April 14, the driver quoted 5,400 yuan, which more than doubled. And on April 15, as the number of foreign drivers in Shanghai decreased, the latest price increased by 1,000 yuan. This virtually causes certain cost to increase.

Foreign trade order quantity fluctuates now, freight forwarder starts to fight price war

At present, the supply of shipping space exceeds demand, and the freight forwarder is extremely busy. The order conversion rate is low, and there is no market for prices. Already freight forwarder begins to hit price war, low snatch goods. Despite this, freight forwarder counterparts said that the recent volume of goods than the same period in previous years declined by two or three.

Freight forwarder business and seller shipments are closely linked. In addition to the epidemic not shipping factors, foreign trade orders also fluctuate.

For many foreign trade enterprises, orders increased sharply last year because of the epidemic abroad. But customer orders fell more this year, even less than in 2019. Some export enterprises say that for products with high value, the sea freight of a container going to Europe accounts for 20%-30% of the value of the goods, and the sea freight of products with low value can account for more than 50%. For foreign buyers, this is comparable to what they would pay directly in Europe and also saves time and customs duties.

In addition, for textile exporters, as factories in Southeast Asia resume production, there is concern about the loss of foreign trade orders. Sea freight is only one of the links, the whole foreign trade environment is not very good.

In view of the recent export order outflow challenges faced by some foreign trade enterprises, the Ministry of Commerce said that it would do everything possible to help enterprises seize orders and expand the market. The Executive meeting of The State Council held on May 5 further increased support for foreign trade enterprises in terms of securing orders, improving the efficiency of customs clearance and increasing credit issuance.